The open enrollment period for benefits effective January 1, 2014 ends Tuesday, December 3, 2013. Open enrollment is the period during which benefits eligible employees may change benefit plans, add or drop coverage and/or add or drop eligible dependents. Changes made during this period will be effective January 1, 2014.

If you are not making changes, you do not need to take action for medical or dental coverage. However, you must make an election for 2014 if you want to participate in the Flexible Spending Program. This year, we will be holding informational sessions throughout the 2014 open enrollment period. We strongly encourage you to attend one of the sessions to learn about the plan changes and new options for 2014. In the event you cannot attend a live session, you can click the link to view a pre-recorded version of the presentation. Prerecorded presentation.

All completed forms must be submitted to the Office of Human Resources by COB on Tuesday, December 3. If you have any questions regarding open enrollment, please contact Lisa Corrado at 7-3353, 312.567.3353.

Informational Session Schedule:

|

Date |

Location |

Time |

|

November 18 |

MTCC Auditorium |

9:00am – 10:30am |

|

November 18 |

MTCC Auditorium |

11:30am – 1:00pm |

|

November 19 |

Downtown Campus Room 570 |

10:30am – Noon |

|

November 19 |

Downtown Campus Room 570 |

1:00pm – 2:30pm |

|

November 20 |

Rice Campus |

10:00am – 11:30am |

|

November 20 |

ID Campus |

1:00pm – 2:30pm |

|

November 21 |

IFSH Campus Room 100 |

10:00am – 11:30am |

|

November 22 |

IIT Tower Auditorium |

8:30am – 10:00am |

|

November 22 |

IIT Tower Auditorium |

10:30am – 12:00pm |

|

November 22 |

IIT Tower Auditorium |

1:00pm – 2:30pm |

|

November 22 |

IIT Tower Auditorium |

3:00pm – 4:30pm |

|

November 26 |

IIT Tower Auditorium |

11:30am – 1:00pm |

|

December 2 |

MTCC Auditorium |

9:00am – 10:30am |

|

December 2 |

MTCC Auditorium |

11:30am – 1:00pm |

2014 Benefits Summary

– Plan and rate changes to our current In-Network PPO Plan

– Additional Plan offering NEW for 2014

– New Vendor for Flexible Spending Accounts and Commuter Benefits

– No plan or rate changes to the dental plan offerings

Blue Cross Blue Shield—Medical Insurance

There have been changes to the plan and rates to the In-Network PPO plan. New for 2014, IIT is also offering a second benefit option for medical coverage. Please attend an informational session to learn more about the medical coverage options. Click the links below to see the benefit summaries and to access the medical enrollment form.

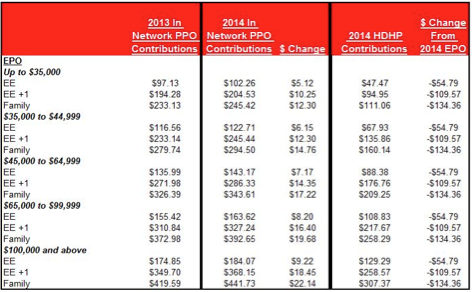

The January 1, 2014, monthly rates for the Blue Cross Blue Shield Medical plans are listed in the following table:

Delta Dental—Dental Insurance

For 2014, there will be no increase in employee premiums to either option. Click the links below for copies of the summaries of the HMO and PPO plan and the enrollment form.

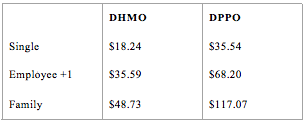

The monthly rates effective January 1, 2014 are as follows:

Flexible Spending—Medical and Dependent Care Flexible Spending

This benefit allows employees to use pre-tax dollars to pay for qualified medical and dependent day care out-of-pocket expenses.

Effective January 1, 2014, the maximum allowable dependent care election is $4,000.

IIT is changing vendors effective January 1, 2014 from Payflex to Wageworks for Medical and dependent care flex and commuter benefits. . YOUR CURRENT FLEXIBLE SPENDING ELECTIONS WILL NOT CONTINUE IN 2014. YOU MUST ACTIVELY ENROLL IF YOU WISH TO PARTICIPATE IN ANY OF THE FLEXIBLE SPENDING ACCOUNT PROGRAMS IN 2014.

If you are interested in enrolling in flexible spending, Wageworks offers online enrollment for Medical, Dependent and Commuter accounts, so no form is necessary. Click the link below to be directed to the WageWorks enrollment page. You may view instructions and an overview of the program by clicking the links below.

Wage Works Online Enrollment Instructions

403b PLAN

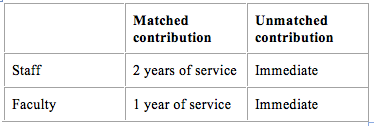

If you are not currently participating in the 403b plan and receiving the employer match and you have met the eligibility requirements as listed below now is a good time to enroll. The university contribution is 5 percent of the annual base salary with no employee contribution and it maxes out at 9 percent with a 4 percent employee contribution. If you are not currently enrolled, please consider investing in your retirement. Complete the salary reduction agreement below to start your contributions.

Salary Reduction Agreement Form